- calendar_month November 8, 2024

- folder Community Engagement

Sharing Tags

Check Your Deed, Deed Fraud, Homeowner Tips, JohnHart, JohnHart Real Estate, Nathan Derry, Nathan Derry Healthy Living, Nathan Derry JohnHart, Nathan Derry Real Estate, Nathan Derry Realty, Nathan Derry Recommends, Nathan Derry Tips, Nathan Derry, JohnHart Real Estate, Property Protection, Protect Your Property, Real Estate Safety, Real Estate Security, Title Fraud

Hello, I’m Nathan Derry with JohnHart Real Estate, and today I want to talk about a rising issue that’s impacting property owners across the country: deed fraud. You may think your property is secure, but unfortunately, this type of fraud is on the rise, impacting not only absentee owners but also multimillion-dollar homes. I’m here to explain what deed fraud is, why it’s becoming more common, and how you can protect yourself.

What is Deed Fraud?

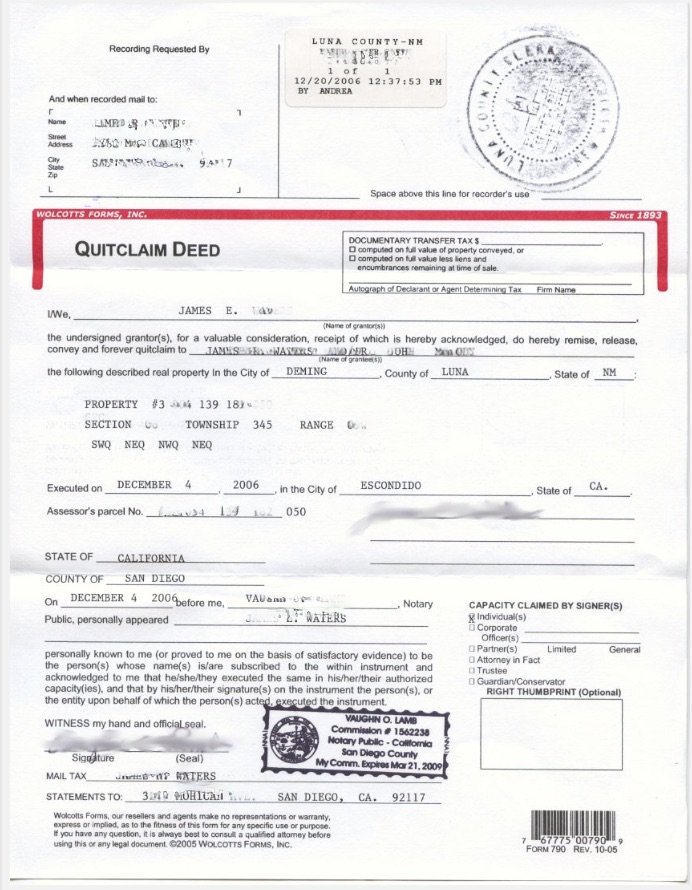

Deed fraud, also known as title fraud, occurs when someone illegally changes the ownership of a property, transferring the title to themselves or an accomplice without the property owner’s knowledge. Once the title is transferred, the fraudster can take out loans against the property, sell it to unsuspecting buyers, or even attempt to evict the rightful owner. Often, the true owner doesn’t realize what’s happened until they’re suddenly facing legal and financial issues.

Why is Deed Fraud Becoming So Common?

Several factors have contributed to the rise in deed fraud:

-

Digital Records: Public records are increasingly available online, making it easier for scammers to access property records and falsify documents.

-

Minimal Oversight: In many cases, transferring a property title doesn’t require in-person verification, which leaves an opening for fraudulent activity.

-

Increasing Home Values: With home values rising, especially for high-end properties, fraudsters are more motivated to target valuable assets.

-

Absentee Owners: Properties owned by people who live out of state or have second homes are especially vulnerable, as fraudsters assume these owners won’t be regularly checking on their properties.

Real-World Impact: Even High-Value Homes Are at Risk

Recently, a high-profile case in Los Angeles highlighted the alarming reach of deed fraud when a scammer attempted to steal ownership of a $137,500,000 mansion. This wasn't an abandoned property or a small, overlooked home; it was a luxurious multimillion-dollar estate. The would-be thief almost managed to transfer the title without the owner’s knowledge, aiming to leverage the property for loans and potential resale. This case shows that even the most valuable properties with prominent owners are vulnerable, underscoring the need for all homeowners to stay vigilant and regularly check their property records.

Deed fraud isn’t just targeting unoccupied homes or abandoned properties. High-value homes are often a target because of the financial gain for scammers. Recently, there have been cases of multimillion-dollar properties in Los Angeles and other urban areas being “sold” without the owner’s knowledge. This trend underscores the fact that no property is immune, regardless of its value or location.

Protecting Yourself Against Deed Fraud

Here are some proactive steps you can take to guard against deed fraud:

-

Regularly Check Your Property Records: It’s important to monitor your deed, especially if you own multiple properties or travel frequently. Even if you live in your home, checking your records helps prevent fraud before it escalates.

-

Enroll in Property Fraud Alert Services: Some counties offer free property fraud alerts, notifying you if there’s any recorded activity related to your property. This can be an invaluable tool to catch fraud early.

-

Secure Important Documents: Store your property-related documents, such as the original deed, in a safe place. If you use digital copies, ensure they’re encrypted and stored in a secure location.

-

Watch for Unusual Activity: If you receive any suspicious mail or phone calls regarding your property, don’t ignore them. Contact your local property records office to verify any activity.

-

Consider Title Insurance: While title insurance doesn’t always cover deed fraud, some policies do offer additional protection against certain types of fraudulent claims.

Why Regular Deed Checks Matter

Waiting until there’s a legal issue or an upcoming sale to check your deed can lead to costly and time-consuming legal battles. If someone successfully transfers your property without your knowledge, you could be liable for any debts or liens they incur, or you might have to go through extensive legal processes to reclaim ownership. Proactive checks can prevent this, saving you from both financial and emotional stress.

To make things easier, I’m offering a free deed copy of your home from my trusted title rep, Eric Avalos with Monarch Title. Just give me a call or text, and we’ll make sure you have a copy of your deed for peace of mind.

Deed fraud may be on the rise, but with vigilance and proactive measures, you can protect your property from falling into the wrong hands. Regularly checking your deed is one of the simplest, yet most effective steps you can take to safeguard your investment. Let’s make sure your home stays yours.

All the best,

Nathan Derry, Realtor

📍JohnHart Real Estate

📞(424) 303-0440

📧 nathan@jhagents.com

👨🏽💻 itsnathanderry.com

You deserve the opportunity to work with an ethical agent. Please give me a call today and let’s discuss your unique needs.

Interested in seeing a property or one of my off market properties in person? Contact me today! Who you hire matters!!!

Ready to make the best move of your life… let’s chat today!