- calendar_month June 25, 2024

- folder Community Engagement

Sharing Tags

California Real Estate, Historic Homes, Historic Preservation, Holiday Home Tips, Home Maintenance, JohnHart, JohnHart Real Estate, Mills Act, Nathan Derry, Nathan Derry JohnHart, Nathan Derry Realty, Nathan Derry Recommends, Nathan Derry, JohnHart Real Estate, Property investment, Real Estate, Real Estate Advice, Renovation Rules

Hello everyone, Nathan Derry here, your trusted Realtor. Today, I want to delve into the unique charm and significant advantages of purchasing a historic home. Buying a historic property can be a fulfilling venture, but it also comes with its own set of considerations. Let's explore the benefits of owning a historic home, what you need to know before making a purchase, the tax benefits available in California, and the regulations surrounding renovations.

Why Buy a Historic Home?

-

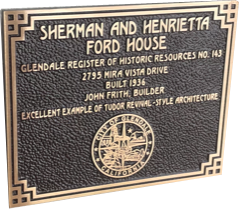

Unique Architectural Details: Historic homes often feature unique architectural elements that are difficult to find in modern properties. From intricate woodwork to original stained glass windows, these homes are a testament to the craftsmanship of the past.

-

Sense of History and Character: Living in a historic home means owning a piece of history. Each house has its own story, adding a rich layer of character and charm that new constructions simply can't match.

-

Potential for Increased Property Value: Historic homes are often located in established neighborhoods with mature landscaping and community amenities. These factors can contribute to higher property values over time.

-

Pride of Ownership: Owning a historic home comes with a sense of pride and responsibility to preserve its legacy. This can be incredibly rewarding for those passionate about history and architecture.

What to Know Before Purchasing a Historic Home

-

Maintenance and Repairs: Historic homes may require more maintenance and specialized repairs. It's essential to budget for potential restoration projects and ongoing upkeep to preserve the property's historical integrity.

-

Insurance Costs: Insuring a historic home can be more expensive than insuring a modern home due to the unique materials and craftsmanship involved. Be sure to obtain quotes and understand the coverage options.

-

Historic Designation: Determine if the home is listed on the National Register of Historic Places or designated as a local landmark. This designation can affect renovation options and eligibility for certain tax benefits.

-

Regulations and Restrictions: Historic homes are often subject to regulations that govern what changes can be made to the property. Understanding these rules is crucial to ensure compliance and avoid fines.

Tax Benefits for Historic Homeowners in California

-

Mills Act Property Tax Abatement Program: The Mills Act provides property tax relief to owners of qualified historic properties who actively participate in the restoration and maintenance of their historic homes. This can result in substantial savings on property taxes.

-

Federal Historic Preservation Tax Incentives: While not specific to California, owners of historic homes may qualify for federal tax credits if they undertake certified rehabilitation projects that adhere to the Secretary of the Interior's Standards for Rehabilitation.

Rules and Laws for Renovating Historic Homes

-

Secretary of the Interior's Standards for Rehabilitation: These standards provide guidance on preserving the historical integrity of a property while allowing for modern updates. Adhering to these standards is often required for eligibility for certain tax benefits and grants.

-

Local Preservation Ordinances: Many California cities have local preservation ordinances that dictate what changes can be made to historic properties. These ordinances aim to protect the historical and architectural significance of the property.

-

Permit Requirements: Renovating a historic home typically requires obtaining permits from local authorities. It's essential to work with contractors experienced in historic preservation to ensure all work meets the necessary standards.

How Does the Mills Act Work?

-

Eligibility: To be eligible for a Mills Act contract, a property must be designated as a historic landmark or located within a designated historic district. The property must also meet certain criteria set by the local government.

-

Application Process: Property owners must apply to their local government to participate in the Mills Act program. The application typically requires detailed documentation of the property's historical significance and a proposed maintenance and restoration plan.

-

Contract Terms: Once approved, the property owner enters into a contract with the local government, usually for a minimum term of 10 years. The contract is automatically renewed each year, extending the term unless either party opts to terminate it.

-

Property Tax Reduction: Under the Mills Act, property taxes are recalculated using a formula that often results in significant tax savings. The amount of tax reduction varies based on factors such as the property's current assessed value, its historical value, and the cost of required maintenance and restoration.

Benefits of the Mills Act

-

Financial Savings: The primary benefit for property owners is the substantial reduction in property taxes. These savings can be reinvested into maintaining and restoring the historic property.

-

Preservation of Heritage: By participating in the Mills Act program, property owners contribute to the preservation of California's cultural and architectural heritage. This helps maintain the historical character of communities.

-

Increased Property Value: Properly maintained historic properties often see an increase in market value. The prestige of owning a recognized historic property can also be a significant benefit.

-

Community Enhancement: Preserving historic properties enhances the aesthetic and cultural value of neighborhoods, making them more attractive places to live and visit.

Considerations for Property Owners

-

Maintenance Obligations: Property owners must adhere to strict maintenance and restoration standards set forth in the Mills Act contract. Failure to comply can result in penalties or termination of the contract.

-

Potential Restrictions: Renovations and alterations to Mills Act properties often require approval from local historic preservation boards. Owners must ensure that all work complies with preservation guidelines.

-

Periodic Inspections: Local governments may conduct periodic inspections to ensure compliance with the contract terms. Property owners should be prepared for these assessments.

-

Contract Termination: While the Mills Act contract renews automatically, either party can choose not to renew, effectively terminating the contract after the remaining term expires. Property owners should understand the implications of contract termination on their property taxes.

Purchasing a historic home offers a unique blend of charm, character, and historical significance. However, it also requires a commitment to maintenance and adherence to specific regulations. By understanding the benefits and challenges, as well as taking advantage of available tax incentives, you can make an informed decision that brings you joy and preserves a piece of history.

If you have any questions or need assistance with purchasing a historic home, feel free to contact me, Nathan Derry, at JohnHart Real Estate, 424-303-0440. I'm here to help you navigate the process and find your dream home.

All the best,

Nathan Derry, Realtor

📍JohnHart Real Estate

📞(424) 303-0440

📧 nathan@jhagents.com

👨🏽💻 itsnathanderry.com

Interested in seeing a property or one of my off market properties in person? Contact me today! Who you hire matters!!!

Ready to make the best move of your life… let’s chat today!